Unlocking Cost Savings: Your Ultimate Overview to Budget-friendly Car Insurance

Browsing the landscape of vehicle insurance policy can frequently really feel frustrating, yet recognizing the important elements can open significant savings. Factors such as your driving background, automobile kind, and coverage selections play a crucial duty in determining your premium prices.

Understanding Car Insurance Coverage Basics

Comprehending the principles of automobile insurance is critical for any vehicle proprietor. Auto insurance policy works as a protective measure against economic loss resulting from crashes, burglary, or damage to your lorry. It is not only a legal need in a lot of territories but likewise a reasonable investment to secure your properties and well-being.

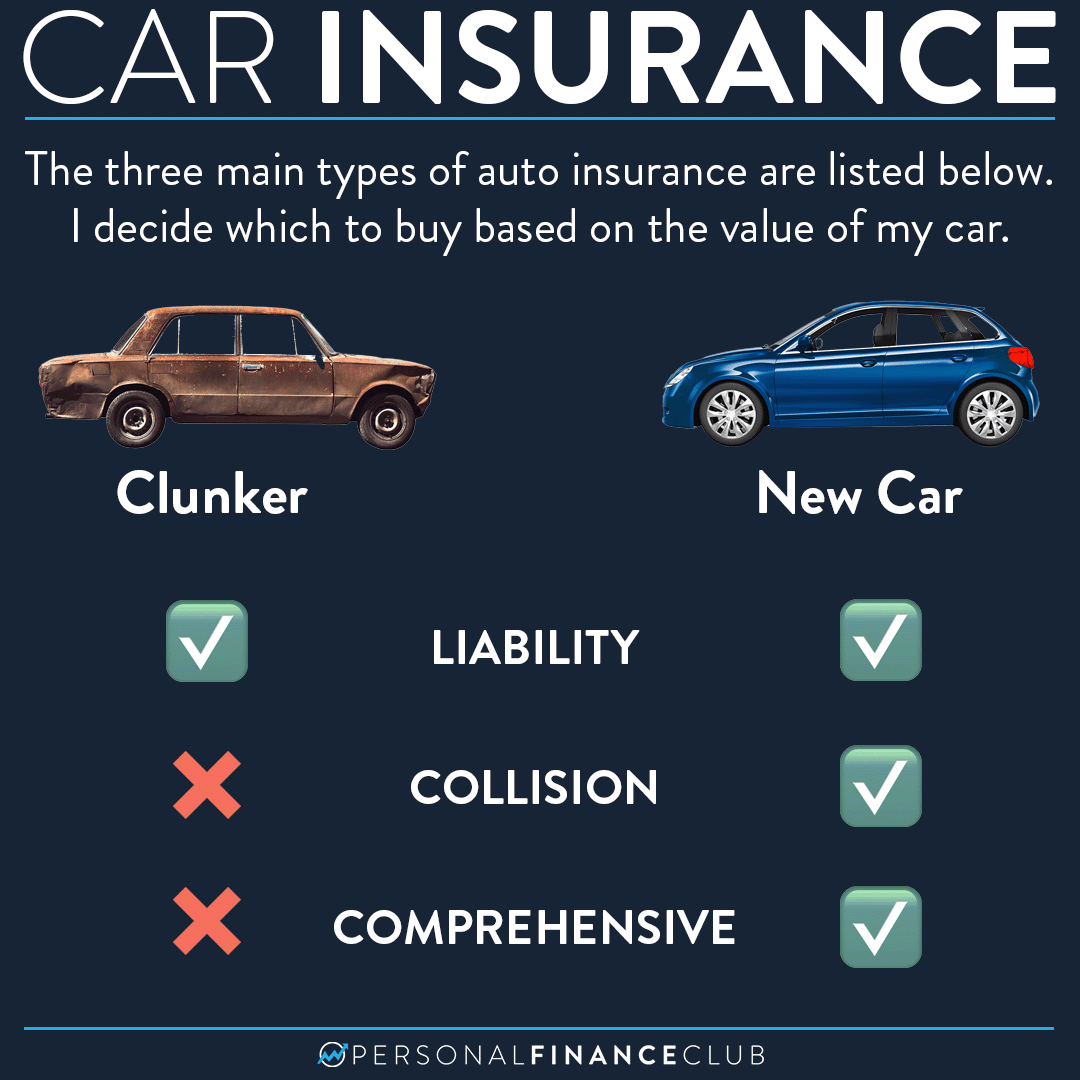

At its core, vehicle insurance coverage typically is composed of several essential parts, including responsibility protection, accident insurance coverage, and extensive insurance coverage. Responsibility coverage shields you against claims developing from problems or injuries you cause to others in a crash. Collision insurance coverage, on the other hand, covers problems to your lorry resulting from an accident with one more automobile or item, while detailed insurance coverage safeguards versus non-collision-related incidents, such as theft or all-natural disasters.

Additionally, understanding plan restrictions and deductibles is important. Policy limits establish the optimum amount your insurance provider will pay in case of a case, while deductibles are the quantity you will pay out-of-pocket before your insurance policy kicks in. Acquainting yourself with these principles can encourage you to make informed decisions, ensuring you choose the best coverage to meet your needs while keeping cost.

Aspects Affecting Costs Expenses

Numerous variables dramatically affect the expense of automobile insurance policy costs, affecting the overall price of protection. One of the primary factors is the vehicle driver's age and driving experience, as more youthful, less knowledgeable chauffeurs normally deal with greater premiums as a result of their boosted risk profile. In addition, the kind of lorry insured plays an essential function; high-performance or deluxe cars and trucks typically sustain higher costs because of their repair work and replacement costs.

Geographical location is another crucial element, with metropolitan locations normally experiencing higher premiums contrasted to rural areas, mainly due to raised web traffic and mishap rates. In addition, the driver's credit report and claims history can additionally affect costs; those with a bad credit rating or a background of regular insurance claims might be billed greater rates.

Additionally, the degree of insurance coverage chosen, consisting of deductibles and plan limitations, can affect premium costs substantially. Lastly, the purpose of the car, whether for personal usage, travelling, or business, might additionally determine costs variations. Comprehending these variables can aid customers make educated decisions when looking for budget-friendly car insurance policy.

Tips for Minimizing Costs

Reducing auto insurance policy costs is attainable via a selection of calculated approaches. One reliable technique is to raise your deductible. By choosing a higher insurance deductible, you can lower your costs, though it's important to guarantee you can conveniently cover this amount in case of an insurance claim.

Utilizing available discount rates can further reduce costs. Numerous insurers offer discounts for safe driving, packing plans, or having particular safety functions in your vehicle. It's wise to ask about these choices.

One more method is to review your credit rating, as several insurer factor this right into premium computations. Improving your credit scores can result in much better prices.

Finally, think about registering try this out in a motorist security course. Finishing such training courses usually certifies you for premium discount rates, showcasing Go Here your commitment to secure driving. By applying these approaches, you can properly reduce your car insurance premiums while keeping sufficient coverage.

Contrasting Insurance Companies

When looking for to lower auto insurance expenses, comparing insurance companies is a vital step in locating the finest protection at a budget friendly rate. Each insurance provider uses unique policies, protection alternatives, and prices structures, which can dramatically influence your general costs.

To begin, collect quotes from multiple providers, guaranteeing you keep consistent insurance coverage levels for an exact contrast. Look past the premium prices; look at the specifics of each policy, consisting of deductibles, responsibility limits, and any type of extra features such as roadside help or rental vehicle coverage. Comprehending these components will assist you determine the value of each plan.

Additionally, take into consideration the credibility and client solution of each company. Study on-line reviews and rankings to determine customer complete satisfaction and claims-handling efficiency. A supplier with a solid track document in solution may be worth a slightly higher premium.

When to Reassess Your Policy

Routinely reassessing your auto insurance coverage policy is critical for making certain that you are obtaining the ideal coverage for your demands and budget - auto insurance. Additionally, acquiring a brand-new car or selling one can modify your insurance coverage requirements.

Adjustments in your driving routines, such as a brand-new task with a longer commute, should also motivate a reassessment. Moreover, significant life occasions, including marriage or the birth of a youngster, may necessitate added link protection or adjustments to existing plans.

Verdict

Attaining savings on auto insurance policy necessitates an extensive understanding of protection demands and premium influencing factors. With attentive comparison of quotes, assessment of driving records, and examination of automobile safety attributes, individuals can uncover potential discounts. Furthermore, methods such as increasing deductibles and routinely assessing policies add to decrease costs. Staying educated and aggressive in assessing alternatives inevitably guarantees accessibility to affordable automobile insurance while keeping sufficient protection for properties.

At its core, automobile insurance policy generally is composed of a number of crucial elements, consisting of liability insurance coverage, collision insurance coverage, and detailed protection.Several factors significantly influence the expense of auto insurance policy costs, impacting the general affordability of coverage. By applying these methods, you can properly reduce your automobile insurance coverage costs while maintaining adequate protection.

Consistently reassessing your auto insurance policy is essential for making certain that you are receiving the finest coverage for your requirements and budget plan.Achieving financial savings on vehicle insurance demands an extensive understanding of insurance coverage demands and costs influencing variables.